Islamic banking Islamic finance Arabic. Pleadings are deemed to be closed at the expiration of 14 days after service of the.

Malaysia Raises Key Rate As Analysts Bet No More This Year Malaysia Raising Rate

Therefore Holdco will be deemed to have received the interest income for the outstanding trade debt in the immediately following YA ie YA 2018.

. 51 Interest income under paragraph 4a of the ITA Subsection 245 provides that interest is assessed as business income under paragraph 4a if. A the debebture mortgage or other source to which the interest relates forms part of the stock in trade of a person. Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News.

Or b the interest is receivable by a person in the course of carrying on a. Under certain circumstances it is possible to defer the taxation of gains up to a certain amount from selling a private real property when a new private real property house or apartment is bought either in Sweden or the EUEuropean Economic Area EEA area. The economy of Malaysia is the third largest in Southeast Asia in terms of GDP per Capita and the 34th largest in the world according to the International Monetary Fund.

Interest paid or credited to any person who is not a tax-resident in Malaysia other than interest attributable to a business carried on by such person in Malaysia is generally subject to Malaysian WHT at the rate of 15 percent on the gross amount. Wang Han Lin v HSBC Bank Malaysia Bhd 2017. The 2018 labour productivity of Malaysia was measured at Int55360 per worker and is significantly higher than in neighbouring Thailand 30840 Indonesia 23890 The Philippines 19630 and Vietnam.

As Holdco controls Sub B Holdco is deemed to be able to obtain the interest on demand in the basis period immediately following the relevant period of YA 2017. مصرفية إسلامية or Sharia-compliant finance is banking or financing activity that complies with Sharia Islamic law and its practical application through the development of Islamic economicsSome of the modes of Islamic bankingfinance include Mudarabah profit-sharing and loss-bearing Wadiah safekeeping Musharaka joint venture. A tax treaty between Malaysia and the recipients country of residence may reduce the rate of WHT.

A tax rate of 22 applies to the sale of private real property and tenant owners apartments.

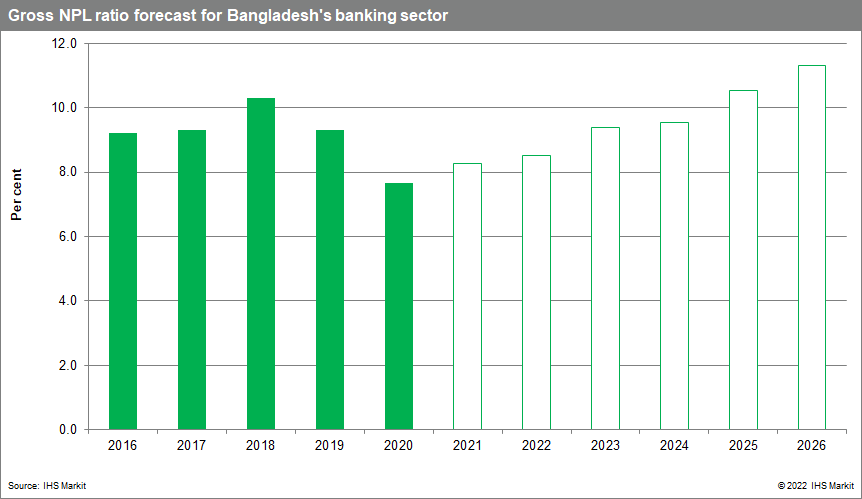

Banking Risk Monthly Outlook February 2022 Ihs Markit

Emerging Markets Monitor Archive Lazard Asset Management

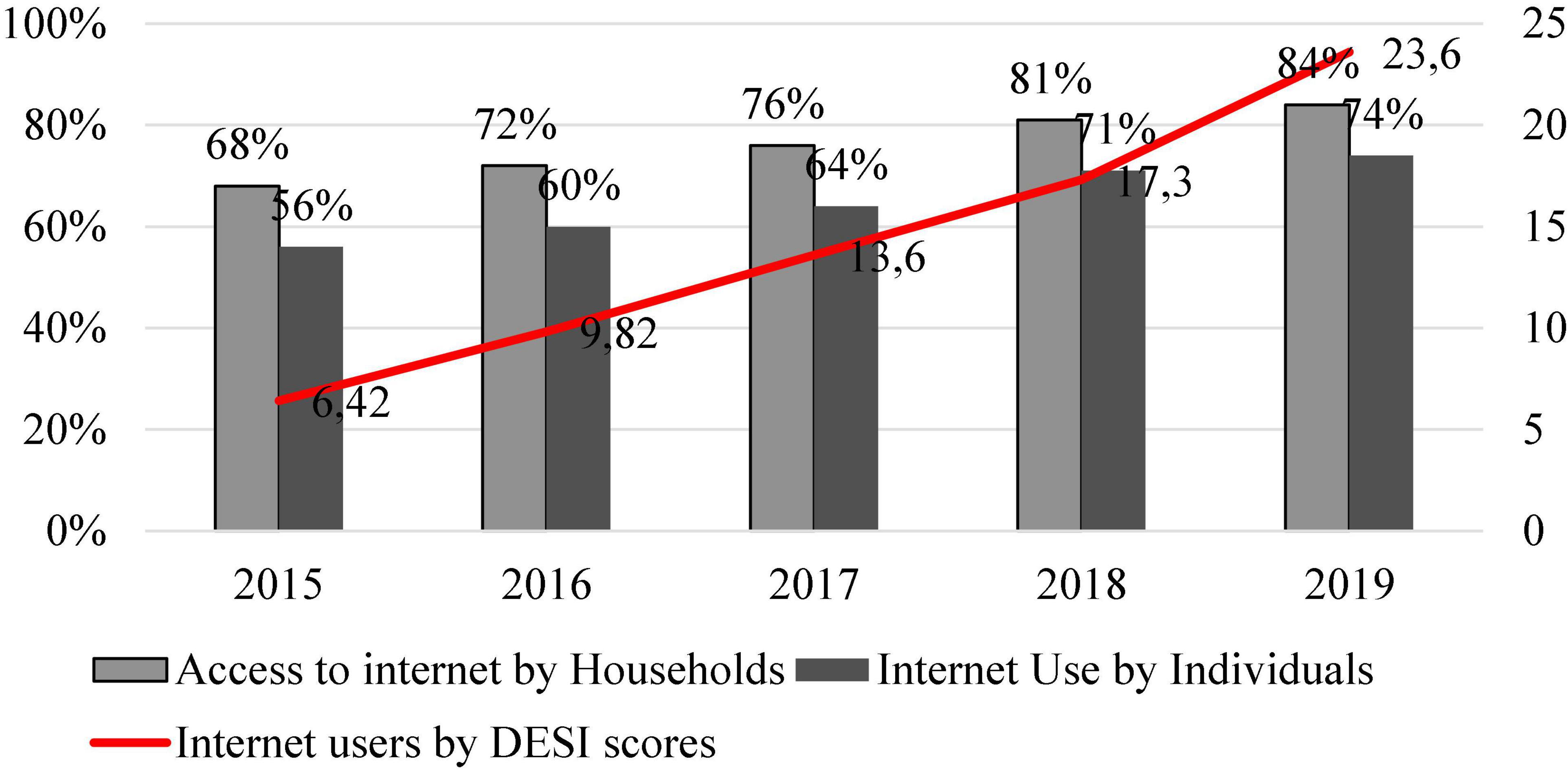

Consumer Barometer Study 2017 The Year Of The Mobile Majority

Consumer Barometer Study 2017 The Year Of The Mobile Majority

Emerging Markets Monitor Archive Lazard Asset Management

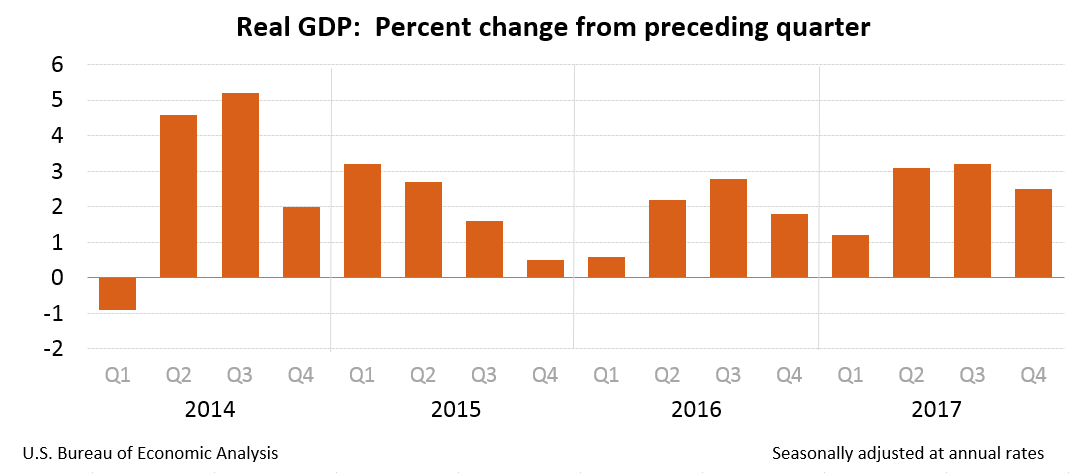

Gross Domestic Product 4th Quarter And Annual 2017 Second Estimate U S Bureau Of Economic Analysis Bea

Global Polypropylene Prices 2022 Statista

Ripintel Amd Ryzen Threadripper 3960x Linux And Windows Cpu Benchmarks Linux Amd Intel

How Frequency Of Exposure Can Maximise The Resonance Of Your Digital Campaigns Nielsen

Frontiers Self Assessed Digital Competences Of Romanian Teachers During The Covid 19 Pandemic Psychology

2017 Raats Mr Mvemve Raats De Compostella Stellenbosch Prices Stores Tasting Notes Market Data

Have Bilateral Free Trade Agreements Bftas Been Beneficial Lessons Learned From 11 U S Bftas Between 1992 And 2017 Plos One

Facebook Fake Account Deletion Per Quarter 2022 Statista

Miss Universe Malaysia 2017 Under Fire For Comments On Us George Floyd Protests Inside Edition

Global Polypropylene Prices 2022 Statista

Consumer Barometer Study 2017 The Year Of The Mobile Majority

Snb Shares Continue To Spiral Touching 6 000 Francs Chart Numerology Chart Government Bonds

The Statistics Behind The Growth Of Rock Climbing Bouldering 99boulders